Home Loan EMI Calculator

Planning to buy your dream home? Calculate your exact monthly payments instantly with our advanced Home Loan EMI calculator. Know exactly what you’ll pay each month before making the biggest financial decision of your life.

Understanding Your EMI Results

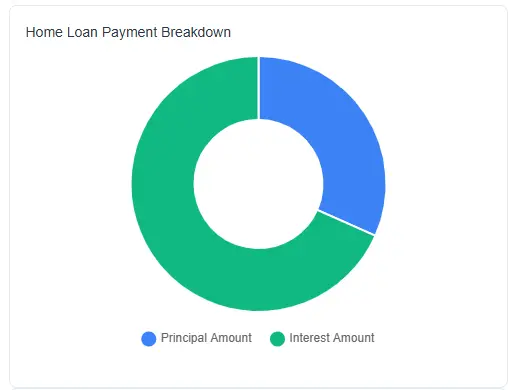

Your EMI calculation shows precisely how your monthly payment splits between principal repayment and interest charges. The total payment amount includes both components, giving you complete visibility into your financial commitment.

Suggest showing a chart that splits the total payment into principal and interest amounts, along with the monthly EMI figure.

For a ₹50 lakh loan at 8.5% interest over 20 years, your monthly EMI would be ₹43,391. This breaks down to ₹21,45,859 in total interest and ₹71,45,859 as total payment over the loan tenure. Understanding this breakdown helps you make smarter decisions about prepayments and loan tenure adjustments.

How Our Calculator Empowers Your Home Buying Journey

Our Home Loan Emi Calculator transforms complex financial calculations into simple, actionable insights:

With our EMI calculator, you can get accurate EMI amounts in seconds without manual calculations or complex formulas. See exactly how different loan amounts affect your monthly budget.

You can test different combinations of loan amount, interest rate, and tenure. Find the sweet spot between affordable EMIs and minimal total interest.

You can calculate how partial prepayments impact your total interest outgo and loan closure date. Make informed decisions about using bonuses or savings for loan reduction.

EMI Formula

EMI = [P × R × (1+R)^N] / [(1+R)^N-1]

P = Principal loan amount

R = Monthly interest rate (Annual rate ÷ 12)

N = Loan tenure in months

Why Understanding EMI is Important

The 3 Key Factors That Decide Your EMI

Principal Loan Amount

The principal is the actual money you borrow from the bank. A higher loan amount directly increases your EMI. For every ₹1 lakh increase in principal at 8.5% interest over 20 years, your EMI rises by approximately ₹867.

Smart borrowers optimize their principal by maximizing down payment. A 25% down payment instead of 20% on a ₹75 lakh property reduces your loan amount by ₹3.75 lakhs, saving you ₹1,61,238 in total interest over 20 years.

Interest Rate

Interest rates determine the cost of borrowing. Fixed rates remain constant throughout the tenure, while floating rates change with market conditions. A 0.5% rate difference significantly impacts your total payout.

On a ₹50 lakh loan over 20 years, the difference between 8% and 8.5% interest translates to ₹2,84,933 in additional interest payment.

Loan Tenure

Tenure is the repayment period for your loan. Longer tenures reduce monthly EMIs but increase total interest payment. Shorter tenures mean higher EMIs but significant interest savings.

For a ₹50 lakh loan at 8.5% interest, choosing 15 years over 20 years increases your EMI by ₹5,872 but saves you ₹6,99,078 in total interest. Balance your current affordability with long-term savings when selecting tenure.

Common Loan Types in India

Home Loan

Interest rates: 8.5% – 11.5% | Tenure: Up to 30 years.

Most popular loan type with tax benefits under Section 80C and 24(b)

Car Loan

Interest rates: 9% – 15% | Tenure: Up to 7 years

Secured loan with the vehicle as collateral, typically faster processing

Personal Loan

Interest rates: 12% – 24% | Tenure: Up to 5 years

Unsecured loan for any purpose, no collateral required

Education Loan

Interest rates: 8% – 15% | Tenure: Up to 15 years

Subsidized rates for students, moratorium period available

Your total EMIs should not exceed 40-50% of your monthly income. This ensures you have enough left for other expenses and emergencies. Always compare offers from multiple banks and choose the best combination of interest rate and tenure.

Frequently Asked Questions

Common questions about home EMI calculations

Need more help? These answers are for general guidance. For specific loan advice, consult with your bank or a qualified financial advisor.